Virginia is for Hyperscale Data Center Lovers

Virginia isn't just for lovers anymore – it's also home to more hyperscale data center capacity than either Europe or China, according to Synergy Research Group.

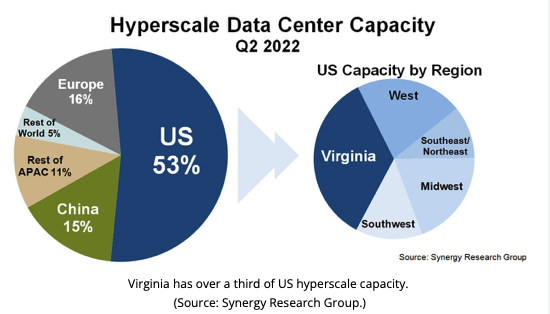

The US has over 53% of the global operational hyperscale infrastructure. Virginia alone has over a third (35%) of US hyperscale capacity, concentrated mainly along the border with Washington, DC. Northern Virginia is also referred to as the Internet capital of the world.

Virginia's "Data Center Alley" includes a large concentration of data centers in the towns of Ashburn, Sterling, Manassas and Chantilly, and around Loudoun, Prince William and Fairfax counties. Much of Amazon's data center infrastructure is in Northern Virginia. Microsoft, Facebook, Google, ByteDance and others also have a significant data center presence in the area.

Amazon also plans to build 900,000 square feet of new data centers in western Prince William County in Northern Virginia, according to the Commercial Observer. The hyperscaler said the decision was based on the need to support technological shifts, such as increased demand for cloud computing, over the past decade.

"More affordable technology and a shift to cloud computing has encouraged more businesses to adopt, and employees to embrace, hybrid work-from-home models," Amazon said in its zoning request. "Online retail has fundamentally changed customers' relationship to traditional retail."

The Western US, primarily Oregon and California, is home to the second-largest amount of hyperscale infrastructure in the nation, followed by the Midwest with large concentrations of hyperscale infrastructure in Iowa and Ohio.

When identifying where to build data centers, hyperscale operators factor in "availability of suitable real estate, cost and availability of power supply options, proximity to customers, the risk of natural disasters, local incentives and approvals processes, the ease of doing business and internal business dynamics," said John Dinsdale, a chief analyst for Synergy Research Group, in a statement.

Outside the US, hyperscale capacity is fairly evenly split between China, Europe and other regions (Synergy measures capacity based on critical IT load). The number of large data centers run by hyperscalers reached 800 by the end of Q2 this year.

Looking at Europe, Ireland takes the lead on the concentration of hyperscale capacity, followed by the Netherlands, Germany and the UK.

China has the most capacity in the Asia-Pacific (APAC) region, far outweighing the capacity provided by runners-up Japan, Australia and Singapore. Data centers in China predominantly support Chinese companies such as Alibaba, Tencent and Baidu.

In the Middle East last month, Microsoft launched a new data center in Qatar in response to the region's "growing demand for high performance computing" and access to Microsoft Services.

Synergy based its research on analyzing "the data center footprint of 19 of the world's major cloud and internet service firms, including the largest operators in SaaS, IaaS, PaaS, search, social networking, e-commerce and gaming."

Unsurprisingly, the companies with the broadest hyperscale data center footprint include Amazon, Microsoft and Google. Each company has over 130 data centers, including at least 25 in each of the main regions of North America, APAC and Europe. Amazon, Google, Microsoft, Facebook, Alibaba and Tencent are the leaders in data center capacity.

While areas such as Virginia, Ireland and the Netherlands have historically been popular locations for data centers, Synergy's "analysis of the future data center pipeline shows that the relative importance of these hot spots will tail off a little over the next five years, as hyperscale infrastructure permeates a broader geographic footprint," said Dinsdale.