Data Center Supply Isn't Keeping Up With Demand

Rapid Adoption of AI Causes Space Shortage, Higher Rents

The U.S. data center property market has posted robust growth this year, driven substantially by a rise in artificial intelligence technology that's also creating tight supply.

The demand is exemplified by tech firm Nvidia, a maker of graphics processing units critical for AI. The company is emerging as a powerhouse in the sector with strong second-quarter earnings and a share price that crossed the $500 mark for the first time in the past week.

However, this kind of growth means some major and secondary cities are struggling with a supply and demand imbalance when it comes to data centers. That's leading to a shortage of space and rising prices, according to a new report from real estate firm JLL.

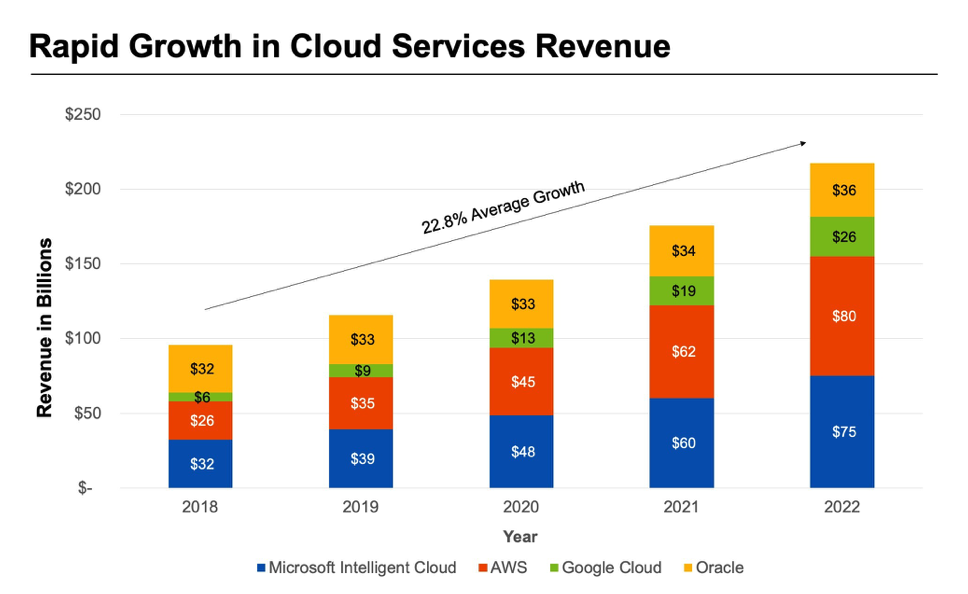

Major cloud service providers are expanding rapidly to support new AI requirements and the need for more computing power. This led to a significant surge in second-quarter leasing, JLL said.

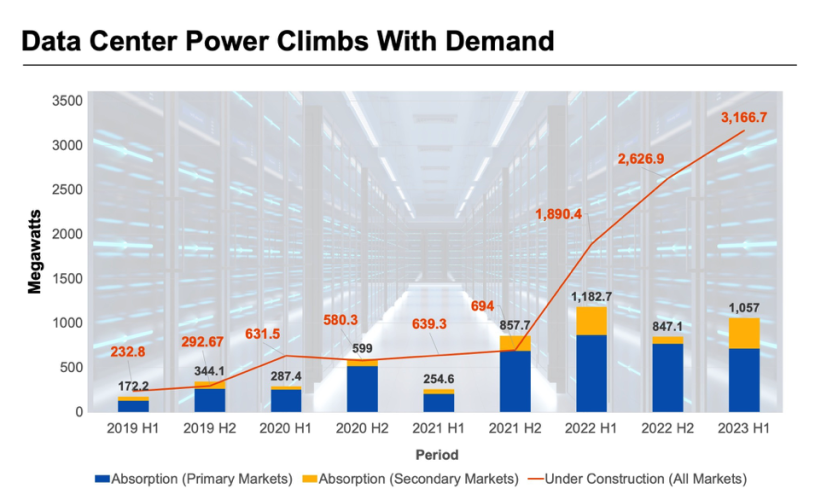

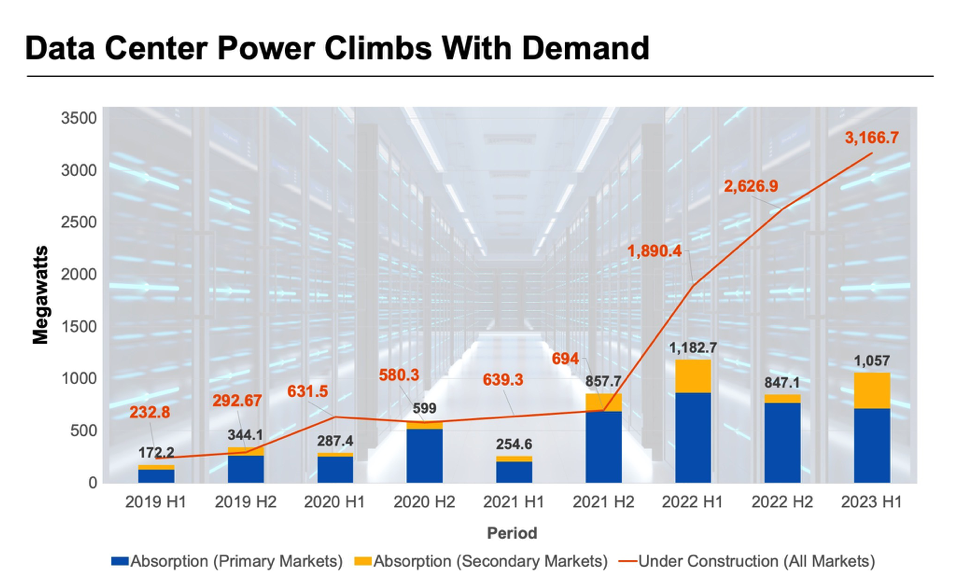

The first half of 2023 experienced record absorption, with more tenants moving in than moving out, as cloud service providers, financial firms, healthcare companies and other users gobbled up data center space, JLL said. Megawatts, the standard unit for measuring data center power, also reached a record high of 3,166.7 megawatts. One megawatt is equivalent to 1 million watts, or the output of about 10 car engines.

Most U.S. markets are unable to satisfy demand with current and near-term supply levels, according to JLL. As a result, operators in primary markets have raised rents by 20% to 30% year over year.

Secondary cities are expected to support the overflow from the constrained bigger ones.

JLL projected investor interest in data centers to remain elevated despite interest rate volatility and regional bank challenges.

By Mark Heschmeyer and Nicole Smith August 27, 2023 CoStar News